Is The Americanemergencyfund.com Loan a Scam? My Experience

American Emergency Fund floods Youtube and Facebook with Ads offering $5000 fund that isn’t as genuine as it seems. Behind the tempting Advertisement, something shady is happening in the background. This article sheds a light on what American Emergency Fund is, from a borrower’s perspective.

My Experience Applying for a Loan on Americanemergencyfund.com

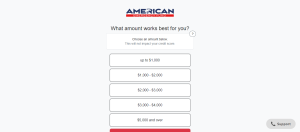

Drawn by a YouTube Ad promoting the loan, I visited ‘americanemergencyfund.com’. First of all, I was surprised to discover that it is actually an affiliate website that connects borrowers to lenders offering loans. It acts like a middle man.

After selecting the ‘$2000-$3000’ loan option, I was made to provide details about myself; my legal name, email address, last digit of SSN, telephone number, etc. After which I had to wait for opt to 48hrs before I was contacted by a lender.

I was shocked when I was told the interest rate for a $3000 loan is 50%. Of course, I didn’t follow through with the loan. However, I’m scared of the information I submitted when applying for the loan.

Americanemergencyfund.com Red Flags

Private Information Required

You will need to provide your personal information such as your Name, Address, SSN and Credit card information. It is important you decide if you are willing to share such vital information. This sensitive information can be stolen and used to commit all kinds of fraud.

No Known Funding

There is no known funding source for the American Emergency Fund. Financial backing can come from anywhere and if you agree to the terms of the loan then you are on your own.

No Owner’s Information

The website business contact address gives the impression that the site is run by TPOLTECH, Inc. However, a search on Companies House Registrar showed that the company has gone out of business for some years now.

Shady Practices

The website isn’t transparent with their loan offer. Aside from using misleading Ads, they also delete comments and reviews left by people on their social media pages. This clearly indicates that something sketchy is going on.

How To Easily Spot Loan Scams

1. The lender isn’t interested in your payment history

Reputable lenders make it clear that they’ll need to look at your credit, sometimes getting reports from all three major credit bureaus (Equifax, TransUnion and Experian). Whereas scammers

2. Isn’t Registered or Licensed To Operate

The Federal Trade Commission (FTC) requires that lenders and loan brokers register in the states where they conduct business. If a lender you’re interested in does not list any registered states, it’s definitely a loan scam.

3. Asks for Upfront Fees

Financial institutions may charge a fee for your application, appraisal or credit report, but those charges are deducted from your loan.

4. The lender calls, writes or knocks

A reputable lender will not target you over the phone, through direct mail or through door-to-door solicitation.

5. The Website isn’t secure

When visiting a lender’s site, what you don’t see can be just as important as what you do see. Always look for:

- A padlock symbol on any pages where you’re asked to provide personal information.

- A URL that begins with “https” instead of “http” (the additional “s” stands for “secure”).

At best, the lack of these safety measures means that the lender isn’t concerned about the integrity of the site. At worst, it could mean that the lender is leaving your information exposed on purpose as part of a loan scam.

6. No physical address

If you don’t find any sign of a physical address, avoid the lender. Many loan scam operators would rather be untraceable so they can avoid legal consequences.

7. The lender pressures you to act immediately

Don’t fall for the urgency plea. One of the hallmarks of loan personal scams is giving you an immediate deadline to sign on for a loan because the offer expires quickly — possibly even the next day.

8. Guarantees approval

There are no guarantees when it comes to personal loan application approval — any company that suggests otherwise should cause you to think twice.

9. Lack of Transparency

Legitimate lenders may charge application, credit report or appraisal fees. However, those fees will be clearly disclosed on the lender’s website.

Conclusion:

$5000 Emergency Fund that Americanemergencyfund.com offers is not a genuine one. The website links borrowers to lenders who ask for high interests. Meanwhile, there’s the possibility of identity theft due to sensitive data collected by the site.

See similar websites that we have reviewed earlier- Viva Payday Loans, Cup loan